Robert M. Kaplan, CPC, QPA, QKC, QKA

Bob Kaplan was the Director of Technical Education for the American Retirement Association (ARA) from 2017 through 2025. In this role he was the Subject Matter Expert for the content of the educational programs for the ARA. Bob was also a frequent speaker at industry conferences and on webcasts. Bob retired at the end of 2025 but still works on educational products and exam review sessions for ARA.

Bob is a former member of ASPPA’s Leadership Council and Co-Chair of the organization’s Government Affairs Committee. Bob is a former member of NIPA’s Board of Directors and the Board of Managers of the American Institute of Retirement Education.

In 2009, Bob was presented with NIPA’s Lifetime Achievement Award for contributions to the retirement industry.

Bob was presented with the prestigious Thomas J. Finnegan III Educator’s Award from ASPPA in 2025 for his dedication to the education of retirement industry personnel.

Bob led McKay Hochman’s education department for 10 years and worked for Voya for 9 years, traveling around the country presenting educational seminars.

Bob has over 45 years of experience in the retirement industry including administration, consulting, sales, and training. He is also a former high school basketball coach.

Fred Reish, Esq.

Fred Reish is an attorney whose practice focuses on fiduciary and best interest standards of care, prohibited transactions, conflicts of interest, and retirement plan issues. He is of counsel at the Ferenczy Benefits Law Center and acts as the Director of ERISA and Fiduciary Strategy for Prime Capital. Fred is a Charter Fellow of the American College of Employee Benefits Counsel. He has been recognized as one of the “Legends” of the retirement industry by both PLANADVISER magazine and PLANSPONSOR magazine. Fred has received recognition awards including the ASPPA/Morningstar 401(k) Leadership Award.

Fred currently serves as a Research Fellow at the Retirement Income Institute. He has written more than 350 articles and four books about retirement plans.

Blaine F. Aikin, CFA®

Retired Financial Services Executive, Devoted Forest Stewardship Practitioner

Professionally, Blaine Aikin retired on July 1, 2024. Immediately prior to retirement, Blaine was the Founder and Principal of Fiduciary Insights, an independent provider of fiduciary subject matter expertise for organizations that employ or provide services to investment advisors.

Fifteen years prior to founding Fiduciary Insights in 2019, Blaine served in the executive leadership of Fi360. He was CEO from 2007 through 2016 and Executive Chairman from 2016 through 2019. Upon retirement, he relinquished his Accredited Investment Fiduciary Analyst® designation administered by Fi360.

For 40 years Blaine has been active in the financial planning community. He served as a Director of the CFP Board of Standards in the United States from 2013 through 2016 and Chair of CFP Board in 2017. In 2018 and 2019 he chaired CFP Board’s Standards Resources Commission and currently serves on the Professional Standards Committee of the international Financial Planning Standards Board (FPSB). Upon retirement, he relinquished the Certified Financial Planner® designation he earned in 1985.

Blaine has retained his Chartered Financial Analyst® designation during retirement, consistent with the policies of CFA Institute.

On the personal side, Blaine is an avid outdoorsman and proponent of sustainable forestry. Family and forests are the focus of his attention in retirement. He is a Pennsylvania Forest Steward and a Master Watershed Steward (programs administered by Penn State University). He currently serves on the volunteer Council of the Finley Center for Private Forests at Penn State and recently served as Council Chair. Blaine resides on forested property in northwest Pennsylvania and actively practices sustainable forestry on property in Pennsylvania and Montana.

Sheldon H. Smith

Sheldon H. Smith, attorney at law, retired from the law firm of Bryan Cave LLP where he practiced in the firm’s Employee Benefits and Executive Compensation client services group and its Fiduciary Litigation client services group, advising clients on ERISA, qualified retirement plans, welfare benefit plans, executive compensation, and fiduciary duties. Mr. Smith practiced law in private law firms for more than 43 years.

During his career, Mr. Smith designed and assisted clients with the implementation and operation of qualified and non-qualified pension benefit plans, welfare benefit plans and equity-based compensation plans. He advised benefits committees and plan sponsor clients regarding their fiduciary duties, performed fiduciary duty compliance audits on employee benefit plans, and conducted fiduciary training. Mr. Smith represented clients before the IRS, Department of Labor, and the PBGC, and, with over 40 years of litigation experience, defended clients in ERISA and benefits, tax and probate litigation. Mr. Smith has also served as a mediator and as an arbitrator in benefits and probate disputes.

Mr. Smith’s clients were both public and private companies, tax-exempt enterprises, and governmental organizations.

From 1980 to 1986, Mr. Smith was a member of either the adjunct or visiting faculties of the University of Denver Sturm College of Law where he has taught in both its Graduate Tax Program and the law school. He received his undergraduate degree (B.A.) from Washington University in St. Louis and both of his law degrees (J.D. and LL.M. (taxation)) from the University of Denver.

Mr. Smith was one of the country’s foremost continuing professional education instructors in his areas of expertise for over 35 years. He presented seminars and gave speeches in most of the states to many diverse types of professional groups, including the American Institute of Certified Public Accountants, more than 30 different state societies of CPAs, Tax Section of the American Bar Association, Western Pension & Benefits Conference, American Society of Pension Professionals and Actuaries (ASPPA), the College for Financial Planning, Financial Planners Association, IACEBS, Thomas Reuters, FTWilliams, banking and insurance organizations, and others. Mr. Smith has authored numerous articles, blogs, and course materials in his areas of expertise.

Mr. Smith served as president of the Denver Tax Group (1983). He was a member of the Western Pension and Benefits Council since 1986 and served as its President (2000) and as President of the Denver Chapter (1999). Mr. Smith is a Past President of ASPPA (2010), sat on the Board of Directors of the American Retirement Association and was a senior advisor to its Government Affairs Committee. Mr. Smith is a Fellow of The American College of Employee Benefits Counsel and has been selected to "Chambers USA - America's Leading Lawyers," "The Best Lawyers in America," "Who’s Who in American Law," "Who’s Who in American Education," and as a Colorado Super Lawyer.

In 2009, Mr. Smith was honored to be named the Outstanding Alumni Law Star by the University of Denver Sturm College of Law. In 2015, Mr. Smith received the prestigious Eidsen Award from the American Society of Pension Plan Professionals and Actuaries.

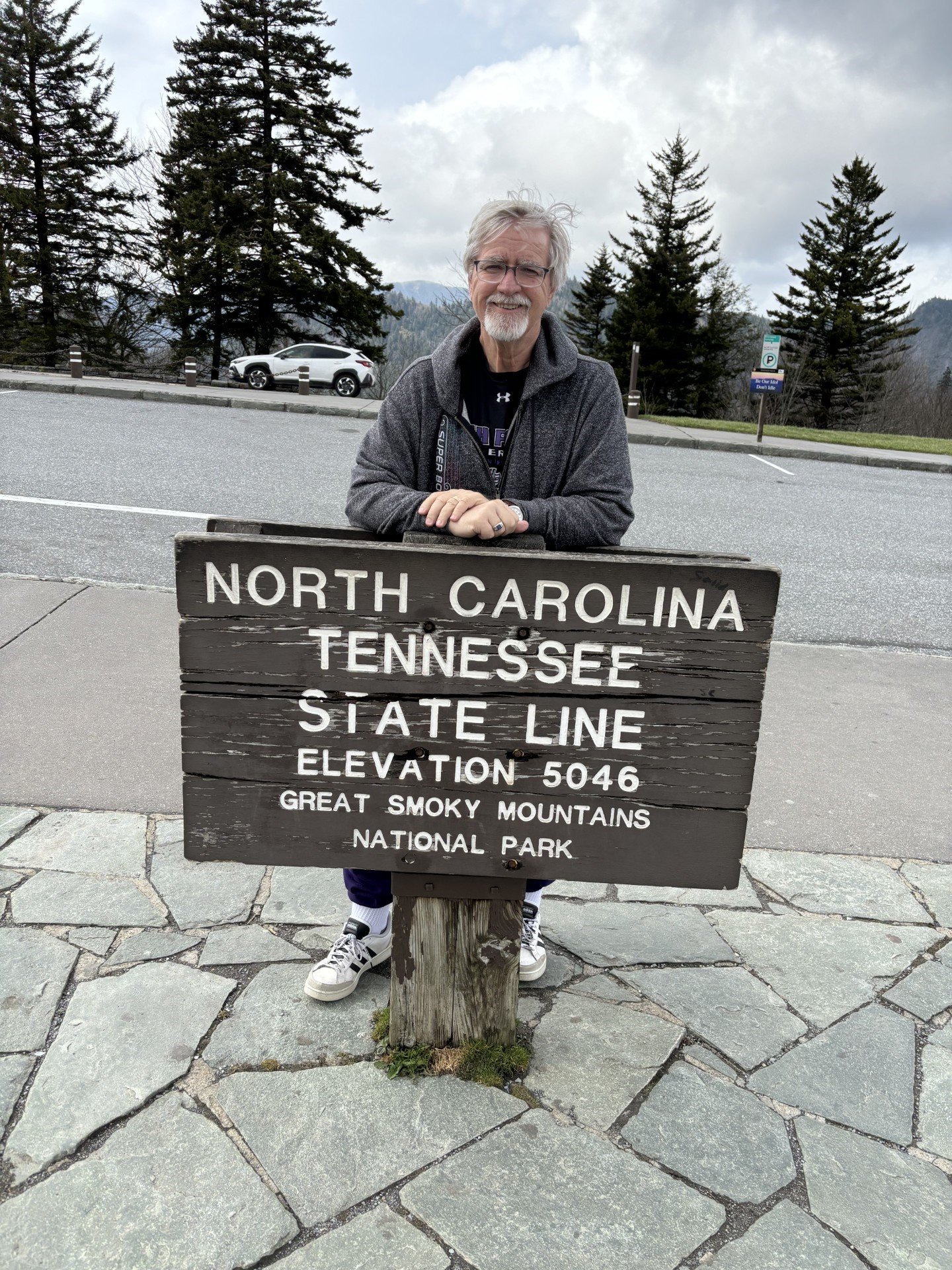

Sal Tripodi

Sal Tripodi maintained a consulting practice in the employee benefits area, TRI Pension Services. Through TRI Pension Services, he provided technical training and consulting services in ERISA-related areas, and conducted numerous seminars around the country, including an annual seminar in Honolulu until 2019. He is the original author of a nine-volume reference guide, “The ERISA Outline Book,” which is used by pension practitioners nationwide. Effective January 1, 2019, the rights to “The ERISA Outline Book” were acquired by the American Retirement Association, which now updates the book. Until January 2024, TRI Pension Services published an electronic quarterly newsletter, eRISA Update. Sal served as the President of the American Society of Pension Professionals & Actuaries (ASPPA) for the 2007-2008 term. He was an adjunct professor at the University of Denver Graduate Tax Program from 1986 through 2007. He started his employee benefits career with the Internal Revenue Service (1979-1983). From 1983 to 2024, Sal worked in the private sector, consulting on employee benefit matters, writing reference materials concerning employee benefit plans, and conducting numerous seminars. In 2001, Mr. Tripodi received ASPPA’s Educator Award and in 2013 was awarded ASPPA’s Eidson Founders Award. He is a Fellow of the American College of Employee Benefits Counsel since 2007. Mr. Tripodi received a J.D. at Catholic University of America Law School (1979) and an LL.M. at Georgetown University Law School (1983).

In retirement, he has become involved in a host of community and charitable activities. He is a founder of the Upper Downtown Neighborhood Association in Denver and chairs the Arts & Beautification Committee, which is focused on fostering more publicly available art in Downtown Denver and enhance the visual aesthetics of the city. He serves on the Board of Directors of his condo association and on the Board of the 14th Street General Improvement District in Denver. He works closely with Elevated Denver, an organization focused on the delivery and accessibility of services to the unhoused. He has been involved in several local political campaigns and works with Mayor Johnston’s office on a regular basis.

Retirement has also provided ample time for Sal and his wife, Mimi, to travel and to visit their daughter Francesca in Chapel Hill, North Carolina, and her husband and two children, and their daughter Maggie in San Bruno, California, and her husband and two children.

Jeanne Thompson

Jeanne Thompson is the founder of Jeanne Thompson Global, a consultancy that partners with forward-thinking organizations to create comprehensive retirement transition programs. After retiring from Fidelity Investments in December 2021, Jeanne discovered firsthand that people need support beyond financial planning to not only make the decision to retire, but to successfully transition into retirement. This lived experience led her to develop an innovative approach addressing five essential pillars often overlooked in traditional retirement planning: creating structure, developing hobbies, evolving identity, building community, and finding purpose.

Through Jeanne Thompson Global, she helps organizations develop structured retirement transition programs that bridge traditional retirement planning with the human elements of transition, empowering people to make confident decisions about their next chapter.

As a sought-after global keynote speaker Jeanne is known for her engaging storytelling and consistently delivers actionable insights with authenticity and warmth. She addresses audiences worldwide on core topics such as: The Retirement Paradox: Why Having Enough Isn't Enough and Beyond the Gold Watch: Designing Retirement Transitions That Actually Work. Currently, Jeanne is working on a book about navigating the transition to retirement, further extending her mission to help others thrive in this important life stage.

Prior to founding her consultancy, Jeanne spent three decades in financial services, with the majority of that time in Fidelity’s 401(k) business and culminated her time at Fidelity working with Fortune 100 companies in her role as Senior Vice President of Benefits Consulting.

Throughout her career, Jeanne’s insights have been featured in top tier media outlets including The New York Times, Kiplinger’s, The Motley Fool, Reuters, Bloomberg, The Wall Street Journal, Time Magazine, USA Today, Washington Post, Newsweek, CNBC and CNN Money. In addition, she has amassed a following of 35,000 retirees and pre-retirees on TikTok who value her unique and authentic perspective on all things retirement.

Drawing on decades of experience in the retirement industry, her ability to connect on a human level with audiences globally and significant media recognition, Jeanne is a trusted expert on amore holistic approach to retirement transitions.

Mark Davis

Mark retired as a Partner at CAPTRUST after a 30-year career as an independent advisor. Mark's career focused on providing investment advisory services to fiduciaries of corporate retirement plans. Based in Los Angeles, he served clients from New York to Honolulu. Mark has been frequently quoted in national media and regularly spoke at events on retirement, investment and educational issues. Mark has testified before both the House Ways & Means and the House Education and Labor Committees. He served on the Board of Directors of ASPPA, the American Society of Pension Professionals and Actuaries and on the founding Committee of NAPA, the National Association of Plan Advisors. He was honored with the opportunity to join the Advisory Board of the John Marshall School of Law in Chicago Center for Tax Law and Employee Benefits. Mark was named one of the “Top 50 Retirement Advisors” by the 401kwire. Earlier in his career Mark was with Fidelity, Schwab, and GE Capital. Mark lives in Scottsdale, Arizona, with his wife, Tricia.

Dallas Salisbury

Dallas Salisbury was long synonymous with the Employee Benefit Research institute (EBRI) that he led as CEO from its founding in 1978 until 2015 when he was named Resident Fellow and President Emeritus of that organization, a position he held till year-end 2017. He was also chairman and CEO until December 31, 2015, of the American Savings Education Council (ASEC), a partnership of public and private-sector institutions that undertake initiatives to raise public awareness as to the needs for insuring long-term economic and health security, and was the image of SavingsmanTM, the spokesperson for the Choose to $ave® (www.choosetosave.org ) public service announcements.

Throughout his career, Dallas has been a member of a number of commissions, study panels and editorial advisory boards. Dallas is a Fellow of the National Academy of Human Resources, the recipient of the 1997 Award for Professional Excellence from the Society for Human Resource Management, and the 1998 Keystone Award of the American Compensation Association. He has served on the Secretary of Labor's ERISA Advisory Council, the Presidential PBGC Advisory Committee, as an advisor to numerous government agencies and private organizations, and on committees of many professional organizations. He has written and lectured extensively on economic security topics. Dallas was one of the statutory delegates to the three National Summits on Retirement Savings hosted by the President and Congressional Leaders, and three White House Conferences on Aging. He has also held full-time positions with the Washington State Legislature, the U.S. Department of Justice, the Pension Benefit Guaranty Corporation (PBGC), and the Pension and Welfare Benefits Administration of the U.S. Department of Labor.

IN 2020 he was appointed by the DC Mayor and DC City Council to a two-year term to represent the public on the DC Board for Long-Term Care Administration to develop implementing rules for licensure of assisted living administrators, including examinations. He fully retired in July of 2022 to focus on family and hobbies. The objective: full control of time and activities.

John Rekenthaler

John Rekenthaler was vice president of research for Morningstar Research Services LLC, a wholly owned subsidiary of Morningstar, Inc.

Rekenthaler joined Morningstar in 1988 and served in several capacities. He has overseen Morningstar's research methodologies, led thought leadership initiatives such as the Global Investor Experience report that assesses the experiences of mutual fund investors globally, and been involved in a variety of new development efforts.

Rekenthaler previously served as president of Morningstar Associates, LLC, a registered investment advisor and wholly owned subsidiary of Morningstar, Inc. During his tenure, he has also led the company’s retirement advice business, building it from a start-up operation to one of the largest independent advice and guidance providers in the retirement industry.

Prior to his role at Morningstar Associates, he was the firm's director of research, where he helped to develop Morningstar's quantitative methodologies, such as the Morningstar Rating for funds, the Morningstar Style Box, and industry sector classifications. He also served as editor of Morningstar Mutual Funds and Morningstar FundInvestor.

Rekenthaler holds a bachelor's degree in English from the University of Pennsylvania and a Master of Business Administration from the University of Chicago Booth School of Business, from which he graduated with high honors as a Wallman Scholar.

Mathew Greenwald

Mathew Greenwald is the Founder and Managing Director of Strategic Initiatives of Greenwald Research, a market research firm, founded in 1985, that specializes in retirement, life insurance, employee benefits and other financial services issues. He has a Ph.D. in sociology from Rutgers University. Dr. Greenwald was a Congress-appointed delegate to the 1998 and 2002 National Summits on Retirement Savings. He has published numerous articles on retirement issues. He is an elected member of the Market Research Council, a group of the country's leading market researchers. He is the only market researcher in the Insured Retirement Institute’s Annuity Hall of Fame.

His firm has worked with the Employee Benefit Research Institute to conduct the Retirement Confidence Survey, which has annually monitored American’s attitudes toward retirement since 1991. Greenwald Research was a member of a Financial Literacy Center funded by the Social Security Administration and worked with researchers from the University of Pennsylvania, Dartmouth College, RAND, the University of Illinois and others to conduct research on how to help Americans make better decisions on retirement related issues.

Prior to founding Greenwald Research, Matt spent 12 years at the American Council of Life Insurers. From 1977 to 1985, he was ACLI's Director of Social Research and was responsible for programs monitoring public attitudes toward financial services issues, demographic research and futures research.

Greenwald Research has conducted research for many of the nation’s most prominent financial services companies, including Fidelity Investments, J. P. Morgan, Lincoln Financial Group, MetLife, Morgan Stanley, New York Life, Northern Trust, Principal Financial Group and Prudential. He has directed numerous studies for the Society of Actuaries.

Karen A. Jordan

Karen A. Jordan is a retired pension consultant with more than 40 years in the retirement plan business. Formerly, she was president and an owner of Alaska Pension Services, Ltd. (APS), a pension consulting firm in Anchorage, Alaska. Karen is a past president of the American Society of Pension Professionals and Actuaries (ASPPA), which is headquartered in Arlington VA. With ASPPA, she earned the designations of Certified Pension Consultant, Qualified Pension Administrator and Qualified 401(k) Administrator. She was also an Enrolled Retirement Plan Agent under the IRS.

Locally, Jordan is a member of Anchorage East Rotary Club, the Alaska Athena Society, and serves on the board of the Wacky Women Golf Association. She has served on the Municipality of Anchorage Investment Advisory Commission and the board of directors of Girl Scouts of Alaska. She has also been a Leadership Anchorage Mentor, a founder of the Anchorage ERISA Forum, past president of the Anchorage Estate Planning Council, and has served on the board of directors of the Downtown Anchorage Association where she co-chaired the committee that raised funds to build the Anchorage Town Square.

Jordan grew up in Wayzata, Minnesota, and attended Macalester College in Saint Paul, Minnesota. She taught high school mathematics at Wayzata High School and worked for seven years at William M. Mercer, Incorporated, in Minneapolis before moving to Alaska in 1979 with her husband Jim. Jim and Karen now split their time between Anchorage, Alaska, and Tucson, Arizona. Karen’s interests include music (playing the flute and piano), traveling with her husband Jim, skiing, yoga, swimming, golfing, and reading.

Nevin E. Adams, JD

Now “retired” (whatever that means), Nevin is the former Chief Content Officer and Head of Retirement Research for the American Retirement Association. One of the retirement industry’s most prolific writers, these days he’s “retired,” which means he writes less, but continues to keep his eye on developments in, and threats to, the nation’s private retirement system.

He’s the “Nevin” in the Nevin & Fred podcast (along with renowned ERISA attorney Fred Reish), offering irreverent but relevant perspectives on the critical issues confronting plan sponsors, advisors, and retirement industry professionals.

He’s also the co-host of THIS new podcast— where Nevin (and Fred) explore the way(s) in which various retirement industry professionals have “retired.”

My retirement journey is still being mapped out—but of course I’ve written about it…some….

The Biggest Surprise About (My) Retirement (napa-net.org)

Retirement Industry Leader Nevin Adams to 'Retire' (napa-net.org)

My 'Retirement' Account (napa-net.org)

And now he talks to his UN-retired buddy Fred Reish about his thought process—and the “experience”—to date.

The Honorable Phyllis C. Borzi

Following her unanimous confirmation by the U.S. Senate, the Honorable Phyllis C. Borzi served as the Assistant U.S. Secretary of Labor of the Employee Benefits Security Administration (EBSA) during the Obama Administration from 2009 until 2017, overseeing approximately 700,000 private-sector retirement plans, approximately 2.3 million group health plans, and a similar number of other welfare benefit plans that provide benefits to approximately 150 million Americans. As agency head, Assistant Secretary Borzi oversaw the administration, regulation and enforcement of Title I of ERISA.

Among her other duties as Assistant Secretary of Labor, she represented the Department of Labor in overseeing implementation of the Affordable Care Act (ACA) insurance market reforms and other ACA rules affecting employer-sponsored group health plans, and she was instrumental in the development of various pension regulations, including the Department’s rule requiring individuals providing financial advice to plan sponsors and retirement investors to act as ERISA fiduciaries.

Ms. Borzi also represented the Secretary of Labor in the Secretary’s role as statutory trustee for the Social Security (OASDI) and Medicare Trust Funds and in the Secretary’s capacity as chair of the Board of the Pension Benefit Guaranty Corporation (PBGC) and was the head of the U.S. delegation to the Organisation for Economic Co-operation and Development (OECD) Working Party on Private Pensions and Insurance

From 1995-2009, Ms. Borzi was a research professor in the Department of Health Policy at George Washington University Medical Center's School of Public Health and Health Services. In addition, she was Of Counsel with the Washington, D.C., law firm of O'Donoghue & O'Donoghue LLP during that time. From 1979 to 1995, Ms. Borzi served as Pension and Employee Benefit Counsel for the U.S. House of Representatives, Subcommittee on Labor-Management Relations of the Committee on Education and Labor. She is the author of numerous articles and a frequent speaker on employee benefit issues to audiences both in the U.S. and globally.

Ms. Borzi currently is an independent consultant and serves on the Board of Visitors of the Columbus School of Law at Catholic University, the Board of Edelman Financial Engines, LP, the Board of the Institute for Fiduciary Standard, the Board of Directors of FAIR Health, the Board of the Maryland Small Business Retirement Savings Trust (Maryland$aves), and the Advisory Board of the Georgetown University’s McCourt School of Public Policy’s Center for Retirement Initiatives. In addition, Ms. Borzi currently serves as a fiduciary representing Retiree Class Members on the Committee of the Goodyear Retirees Health Care Trust. She was previously appointed by the Federal district court in Ohio as an Independent Public Member on the Committee from its inception until 2009.

She received her law degree from the Columbus School of Law at The Catholic University of America where she was the Editor-in-Chief of the Law Review and is an active member of the American Bar Association, including service as former Chair of the Joint Committee on Employee Benefits. Ms. Borzi is a Charter Fellow and former Chair of the American College of Employee Benefits Counsel.

Charlie Nelson

One of the retirement industry’s most innovative leaders, Nelson led not one, but two major retirement companies, Voya and Great-West Life.

As the Vice Chairman and Chief Growth Officer at Voya Financial, he supported the shape of Voya’s growth strategy, both organic and inorganic, including a robust customer segmentation strategy to align solutions to specific customer and market needs. As CEO of Retirement & Employee Benefits at Voya, he led all aspects of the retirement & employee benefits businesses representing more than 12M participants and employee benefit policy holders. He began his career with Great-West Life (now Empower) progressing over three decades to ultimately serve as the organization’s EVP where he led all defined contribution and defined benefit plans.

After a career focused on helping individuals protect and save their money—getting the best financial outcomes they can for themselves and their families – in his “next chapter” he hopes to continue to find ways to educate and support others in achieving a future of financial wellness.